By Josh Mayne

March 2021 was not just the last month that saw Investec, as a provider offer product to the UK retail market but was also the month when the last of the plans issued by Morgan Stanley, as a provider matured in the market. In this article I examine the latter’s history and performance.

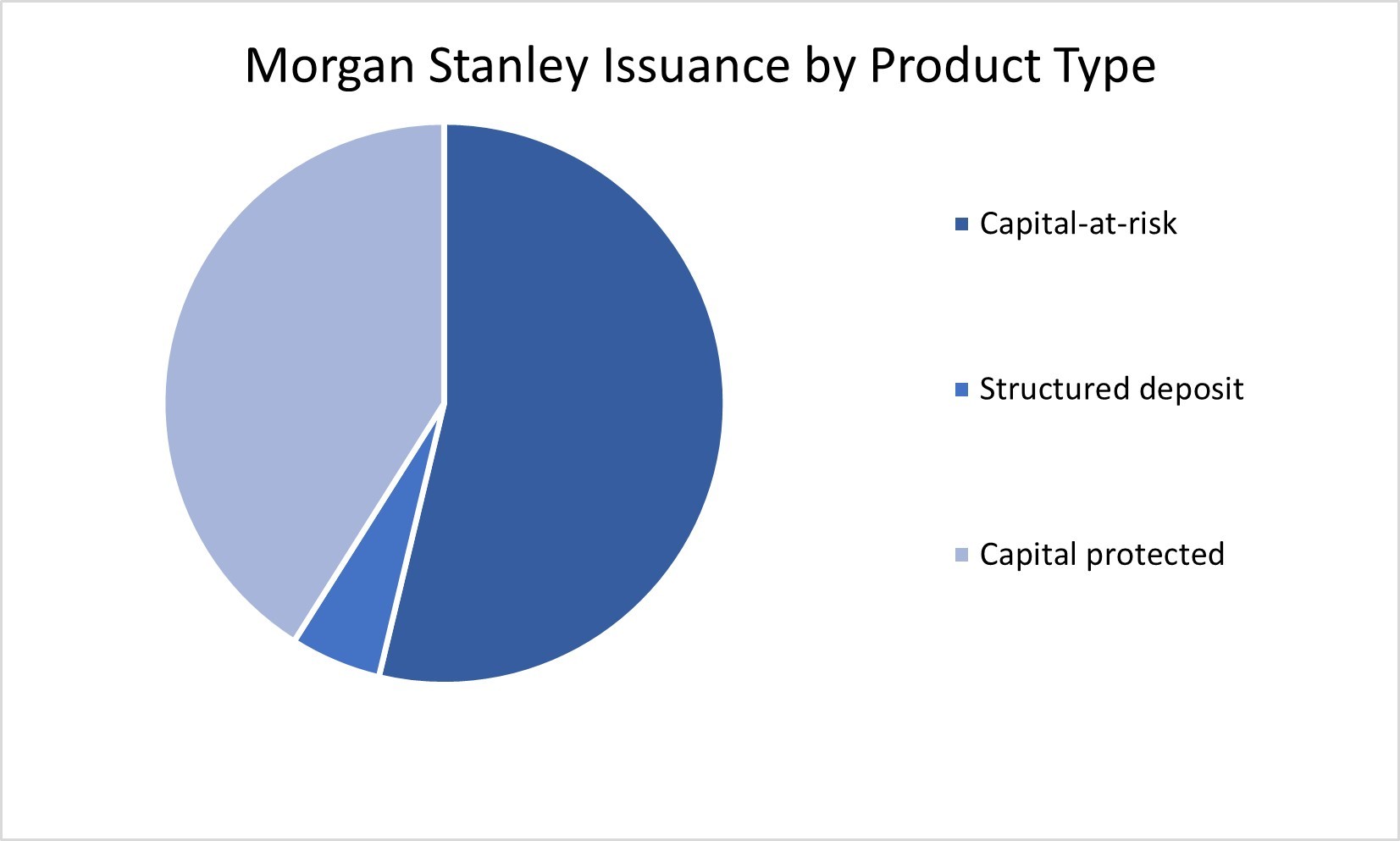

First appearing in the UK retail structured product market back in 2003, Morgan Stanley ultimately issued 268 products via IFAs, covering structured deposits, capital-at-risk and capital protected products. Over half of Morgan Stanley’s plans were capital-at-risk (53.25%) in structure, with capital protected and structured deposits accounting for 41.41% and 5.22% of issuance, respectively.

The first Morgan Stanley (MS) plans, issued in Q1 2003, were a suite of eight, rather convoluted, FTSE 100 linked sub plans dubbed Morgan Stanley Optimiser range. Three months later the first Protected Growth Plan was launched and this was the first to mature, three years later returning capital plus 25%.

The final tranche of retail products issued by MS as a provider came to market in 2015 and the last of these matured at the end of their six-year terms in March 2021. The deposit amongst the last three returned no interest, the growth plan returned a 16.69% gain and the income plan paid 6.75% per annum in addition to returning all of the original investment. Considering that over their six-year term the FTSE 100 Index, to which all three were linked, was down by 5.16% these were pretty respectable results. Indeed, the overall returns of all 268 MS products were very respectable, with not a single one resulting in a capital loss despite many commencing up to and around the financial crisis and some maturing at the height of the Covid pandemic.

The average annualised return of all MS maturities was 6.05% across an average term of four and a half years. A more detailed breakdown of Morgan Stanley products’ maturity performance is as below.

|

|

Capital-at-Risk |

Capital ‘Protected’ |

Structured Deposits |

|

Number of maturities |

143 |

111 |

14 |

|

Number returning a positive outcome |

138 |

83 |

8 |

|

Number returning capital only |

5 |

28 |

6 |

|

Number returning a loss |

0 |

0 |

0 |

|

Average term (years) |

3.96 |

5.11 |

5.68 |

|

Average annualised return |

8.04% |

3.98% |

2.17% |

|

Average annualised return upper quartile |

12.31% |

8.58% |

4.53% |

|

Average annualised return lower quartile |

4.21% |

0.00% |

0.00% |

.jpg)

229 of the 268 plans (85.45%) achieved a gain for investors, with the balance still successfully returning investors’ original capital – no Morgan Stanley structured product ever matured resulting in a capital loss.

Of the 39 plans that failed to achieve a gain, 22 struck pre-2008 and suffered as a result of the financial crisis crash. Similarly, a further 9 matured post February 2020, meaning they suffered as a consequence of the pandemic-induced market fall. The remaining 8 maturities that returned capital only struck between 2008 and 2009 and were linked to the performance of a range of global developed and emerging market indices – namely the Hang Seng Index, MSCI Taiwan Index and S&P BRIC 40 Index.

The three top performing MS maturities are summarised below.

|

Plan |

Strike Date |

Term to Maturity |

Index Link |

Movement in Index |

Final Gain |

Annualised Return |

|

FTSE Kick Out Growth Plan 14 |

14/12/2011 |

3 years |

FTSE 100 Index |

+15.2% |

65% |

18.13% |

|

FTSE Kick Out Growth Plan 15 |

07/02/2012 |

3 years |

FTSE 100 Index |

+16.07% |

60% |

16.91% |

|

FTSE Kick Out Growth Plan 13 |

26/10/2011 |

3 years |

FTSE 100 Index |

+14.59% |

55% |

15.7% |

The top 20 MS maturities retuned an average annualised return of 14.23% over an average term of 3.17 years; all but two of these were identified as ‘Preferred’ by Lowes on StructuredProductReview.com at the time of launch. Lowes had noted 129 of the 268 plans as ‘Preferred’ and these outperformed the average of all maturities, returning an average of 7.2% per annum over an average term of 4.52 years.

Whilst there were many exceptional offerings from Morgan Stanley over the years and a number of welcome market innovations, to this day they remain the only provider, or counterparty to have issued a UK retail product linked to the performance of the FTSE 250 Index. That capital protected product offered 110% of the rise in the index, with no loss if it fell over the six-year term. The plan ultimately matured with a 66.9% gain.

Morgan Stanley remains a prominent counterparty to structured products in the retail space, like the 10:10 Plan but the final chapter on the bank, as provider of its own structured products has now come to an end. As the results show, it leaves a respectable legacy from a very positive participation in the UK retail financial services sector having served IFAs and their clients very well.

Structured investments put capital at risk.

Past performance is not a guide to future performance.

Also in this section

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶