Over the course of the last ten days we have identified two maturity related issues arising from plans that struck in 2015, albeit for differing reasons...

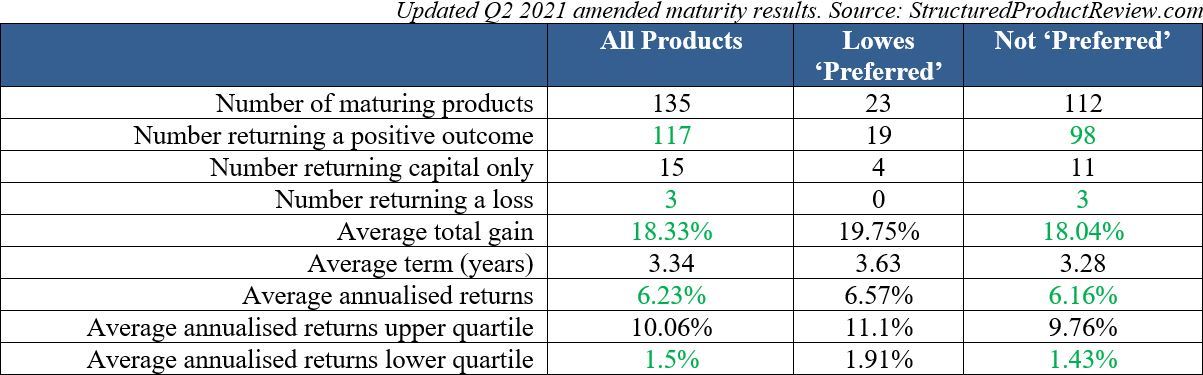

In July we were able to reflect on a vastly successfully period for the structured products sector, with Q2 2021’s maturity results improving on those enjoyed in Q1, which had been the best performing period since the beginning of the pandemic. In our ‘Q2 2021 Maturity Results’ we had reported that of the 135 maturing products, 85.92% (116 plans) realised a gain for investors’, 11.11% (15 plans) returning capital in full without gain, and just 2.96% resulted in a capital loss.

However, it has since been brought to our attention that one of the plans we had listed as being loss making, actually, thankfully, realised a gain. As such, 86.67% of Q2 maturing plans realised a gain and just 2.22% (3) plans resulted in a capital loss, thereby improving on an already successful quarter.

Having been updated, Q2’s maturing plans generated a now improved average annualised return of 6.23% over an average term of 3.34 years.

The plan that we had incorrectly identified as being a loss-making product was the SIP Nordic FTSE 4 Accumulator Kick Out Plan May 2015[1].

This ‘worst-of’ capital-at-risk plan, linked to the performance of four FTSE 100 shares (BP, HSBC, Anglo American and Vodafone), struck in May 2015 and had the opportunity to mature early on any anniversary provided that all four shares closed above their respective initial level. However, adverse share performance throughout the term meant that the plan ran the full six years, until its Final Index Date on 28th May 2021.

On maturity, the worst performing share (Vodafone) closed 49.76% below the initial level recorded on 29th May 2015, which resulted in just 50.24% of investors’ original capital being returned. However, typical of the zeitgeist pre-regulator intervention in 2015, this plan was somewhat convoluted and incorporated a nuance that in this instance benefitted investors favourably.

When preparing our initial Q2 2021 report, we had overlooked the fact that SIP Nordic FTSE 4 Accumulator Kick Out Plan May 2015 included a ‘lock-in’ feature that meant a 6% gain, payable on maturity, was secured for each underlying share that closed above its initial level on any anniversary. Resultantly, investors’ 49.76% capital loss was offset by a locked in gain of 66%; the plan matured returning a total gain of 16.24%, or an annualised return of 2.54% over the 6-year term.

We have retrospectively updated the Q2 2021 Maturity Results to reflect this performance update. To read the updated report, please click here. Ultimately this correction has improved on an already impressive Q2 performance for the sector, however please note that we welcome all comments, criticism or suggestions, whether they’re positive, or negative. If you do have a comment you’d like to share with us, please don’t hesitate to contact info@StructuredProductReview.com.

The second maturity related issue, identified by Lowes, concerned with the maturity of Reyker Securities FTSE 100 Supertracker Plan July 2015[2], and what we believe to be a maturity payment shortfall. This growth plan matured after six years, with a gain equal to ten times the rise in the Index above its initial level (6,696.28), capped at 70%.

By reference to the terms outlined in the product brochure, this contract should have matured with a gain of 57.56% based on the closing level of the FTSE 100 on the Maturity Date of Monday 2nd August 2021. However, Lowes has identified a shortfall in that the counterparty released funds with a gain of only 50.18% which is the return that would have been achieved had the maturity date been Friday 30th July.

Our investigations have revealed that the terms of the contract Reyker engaged with the counterparty stated the final index date as 30th July. The shortfall is therefore apparently the result of an error on Reyker’s part as they incorrectly stated the maturity date in the 2015 product literature, reflecting a lower than acceptable standard of documentation. It is worth noting that the standard of product documentation, including Reyker’s improved shortly after this 2015 issue.

In our opinion, this maturity shortfall is a liability that falls on Reyker and as such, will ultimately become a matter for the FSCS as, due to other failures, Reyker is now in the hands of Administrators Smith & Williamson with insufficient assets to meet its liabilities. Whilst Lowes does not have any clients caught by this latest Reyker issue, we are happy to provide assistance to others, where we can – if you believe we can help, please do not hesitate to let us know.

Also in this section

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶