Please note that these figures were updated on 27th August 2021 - please see here for explanation.

Following on from Q1 2021, when we were able to reflect on it as the best performing period for the UK retail sector since the beginning of the pandemic; impressively, Q2 2021 has gone one better…

In the UK at the time of writing (Gov.uk), over 80 million Covid-19 vaccinations have been given, and Boris Johnson has this week confirmed plans for the biggest lifting of lockdown restrictions since the beginning of the pandemic. It seems that as we edge back into ‘normality’ that the sector, and markets more generally have moved in line with this positivity – albeit not quite reaching pre pandemic levels.

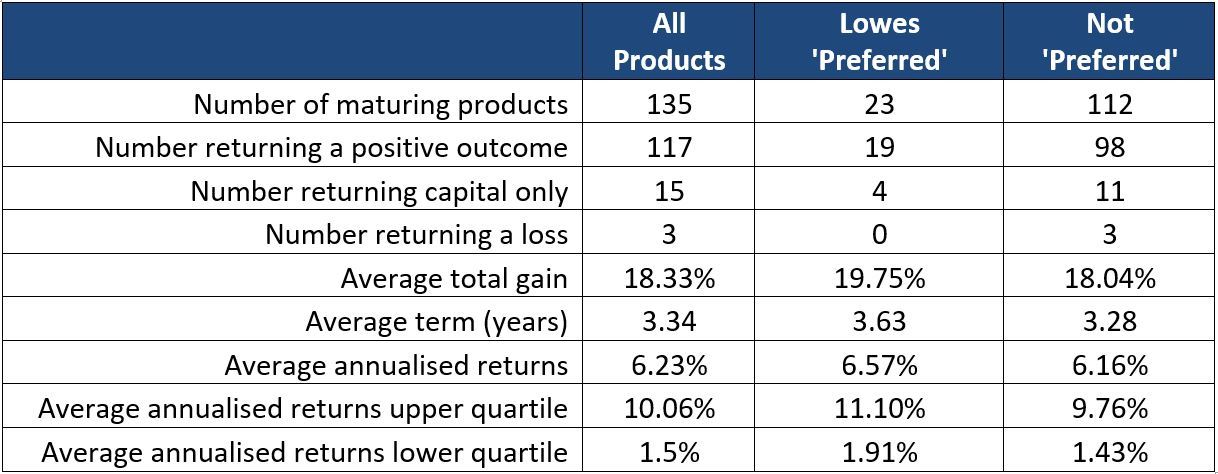

The average FTSE 100 closing level for Q2 2021 was 7,017.40, where the average level for the whole of 2020 was 6,276.21; consequently, Q2 2021 generated a total of 135 maturities throughout its three-month period, which was seven less than the two preceding quarters combined.

Of the 135 maturing products, 86.67% (117 plans) realised a gain for investors’, 11.11% (15 plans) returning capital in full without gain, and just 2.22% resulted in a capital loss. 23 Lowes ‘Preferred’ plans matured in Q2, with all but four realising a capital gain.

Q2’s maturing plans generated an average annualised return of 6.23% over an average term of 3.34 years. Consistent with Q1, Lowes ‘Preferred’ plans outperformed the sector’s average annualised returns by 0.34%, though across a slightly longer average investment term of 3.63 years.

The average annualised returns for the upper quartile of Q2 maturities generated an impressive average annualised return of 10.06%, with the three biggest hitters outlined below…

1. Hilbert Investment Solutions Kick Out Series 3 Stock Defensive Autocall Issue 6. This speculative ‘Preferred’ plan, linked to the performance of three FTSE 100 shares (Vodafone, Aviva and Barclays), matured after just 6 months returning investors original capital in full, in addition to a gain of 10%.

2. Dura Capital Natixis FTSE 100 Autocall Plan 44. This ‘Preferred’ plan, linked to the performance of the FTSE 100 Index, matured after 1 year returning investors original capital in full, in addition to a gain of 14.5%.

3. Meteor FTSE Kick Out Plan April 2020. This plan, again linked to the performance of the FTSE 100 Index, matured after 1 year returning investors original capital in full, in addition to a gain of 13%.

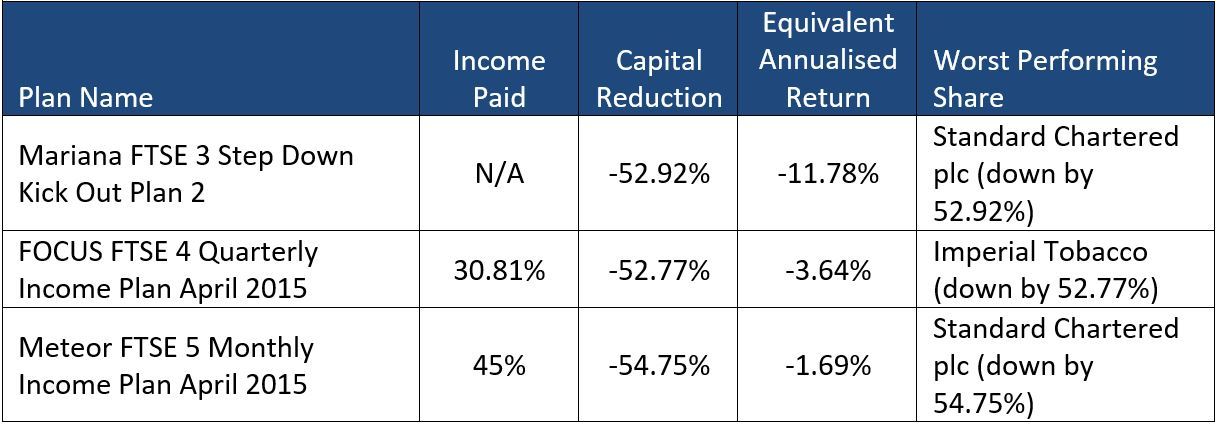

Unfortunately, however, three maturities in Q2 ultimately realised a capital loss for investors. All three plans were inherently risky term contracts, deriving their returns from the performance of a basket of individual shares.

The three loss making Q2 Maturities

It is worth noting that no Lowes ‘Preferred’ plans realised a capital loss.

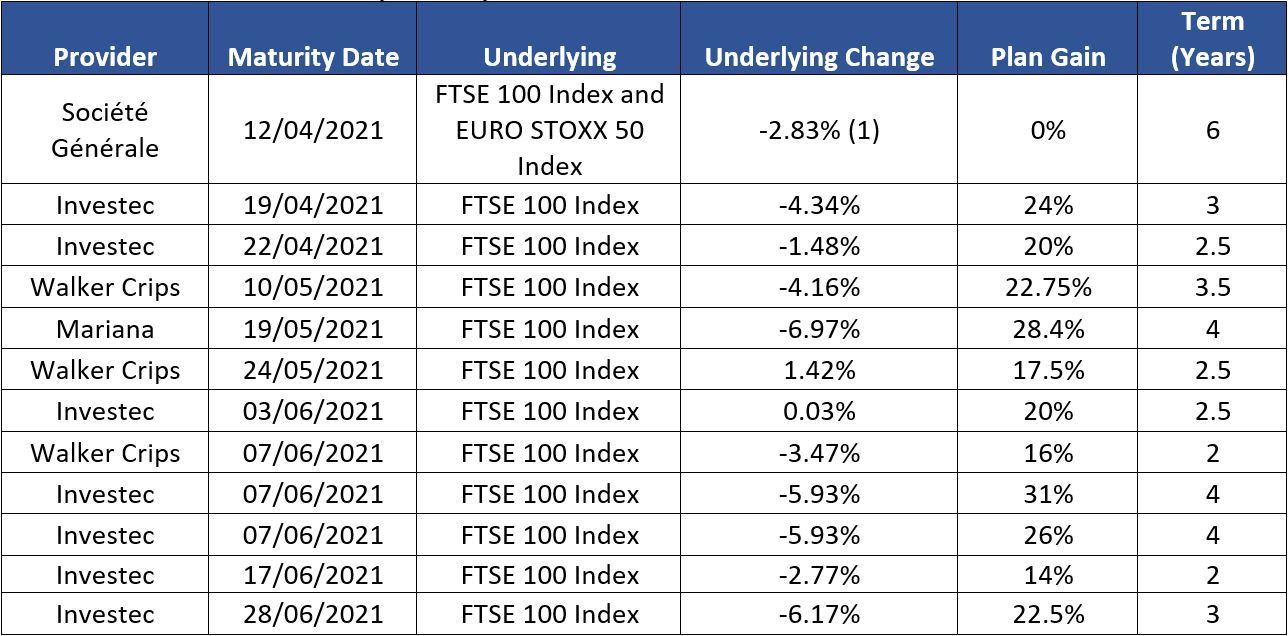

The table below offers a performance summary of the Lowes ‘Preferred’ plans, most commonly held by our clients, that matured in Q2. There were several successful widely held maturities throughout the quarter, not least six Investec / Lowes 8:8 Plans.

Q2 Maturities most commonly held by Lowes clients

(1) Worst performing index (FTSE)

(1) Worst performing index (FTSE)

It is worthy of note that of the above positively maturing plans, all but two generated a gain despite falling markets. All of these FTSE linked plans outperformed the FTSE total return over the same period, highlighting a fundamental benefit of structured products, particularly in flat, or falling markets.

The latest 8:8 Plan, now offered through Mariana, maintains a defensive feature, though in a slightly different format. Full plan details on the plan, including Lowes’ Summary Papers, can be found here.

Next quarter promises to be an interesting one – will pre-lockdown life continue to fall back into place? Will markets follow suit? Will we witness yet another successful period for the UK retail sector?

Structured investments put capital-at-risk.

Past performance is not a guide to future performance.

FTSE 100 data source: Investing.com

Disclosure of Lowes interests: Lowes has provided input into the concept, development, promotion and distribution of the Mariana Capital 8:8 Plans. The provider's charges/fees are built into the terms of the investment - Lowes has a commercial interest in the Plan as a result of its involvement in its development and promotion. All Plan returns are stated after allowing for these charges/fees. Where Lowes is involved in advice on or the intermediation of this investment to retail clients, it will not receive any payment from Mariana for its input. The aim of developing plans in co-operation with providers, with Lowes input, is that they should be amongst the best available in the market. Lowes has robust systems and controls in place to ensure that it manages any actual or potential conflicts of interests in its activities

Also in this section

- 2,000 and counting

- Q2 2024 maturity results

- 20 years of autocall maturities

- Product focus - June 2024

- Fixed income or interest?

- Maturities of the month - May 2024

- The barrier debate - revisited

- Product focus - April 2024

- Maturities of the month - April 2024

- Time to call

- I don't believe markets are ever too high for Structured products!

- Notes on counterparty exposure

- Return of Nikkei

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶