11/11/2021

Six years ago, the first Mariana 10:10 Plan, designed in conjunction with Lowes Financial Management, was released into the retail space. Today, 49 tranches (138 Options) and 41 maturities later, we are able to reflect on what has proven to be a mainstay within the sector.

The first issue of the 10:10 Plan which struck in October 2015 comprised of two options, each deriving their performance from the FTSE 100 Index. In contrast, the most recent issue, Mariana 10:10 Plan December 2021, is comprised of three options each linked to the new FTSE CSDI.

The 10:10 Plan itself has a number of typical features that have remained constant since the pilot launch. Namely, all issues have been autocall contracts meaning that they have been able to mature early on predetermined dates under pre-defined market conditions. The 10:10 Plan has also been consistent in providing a maximum investment term of ten years, which could prove valuable in the event of a prolonged recovery following another black swan event.

Similarly, all issues of the 10:10 Plan have incorporated a 70% European capital protection barrier, meaning that falls in the underlying due to out of the ordinary events such as the Covid correction have no bearing on the barrier, provided the index recovers to at least above the barrier, or better still, the maturity trigger point before the final maturity date.

However, there have been a anumber of different features within the 10:10 Plan remit...

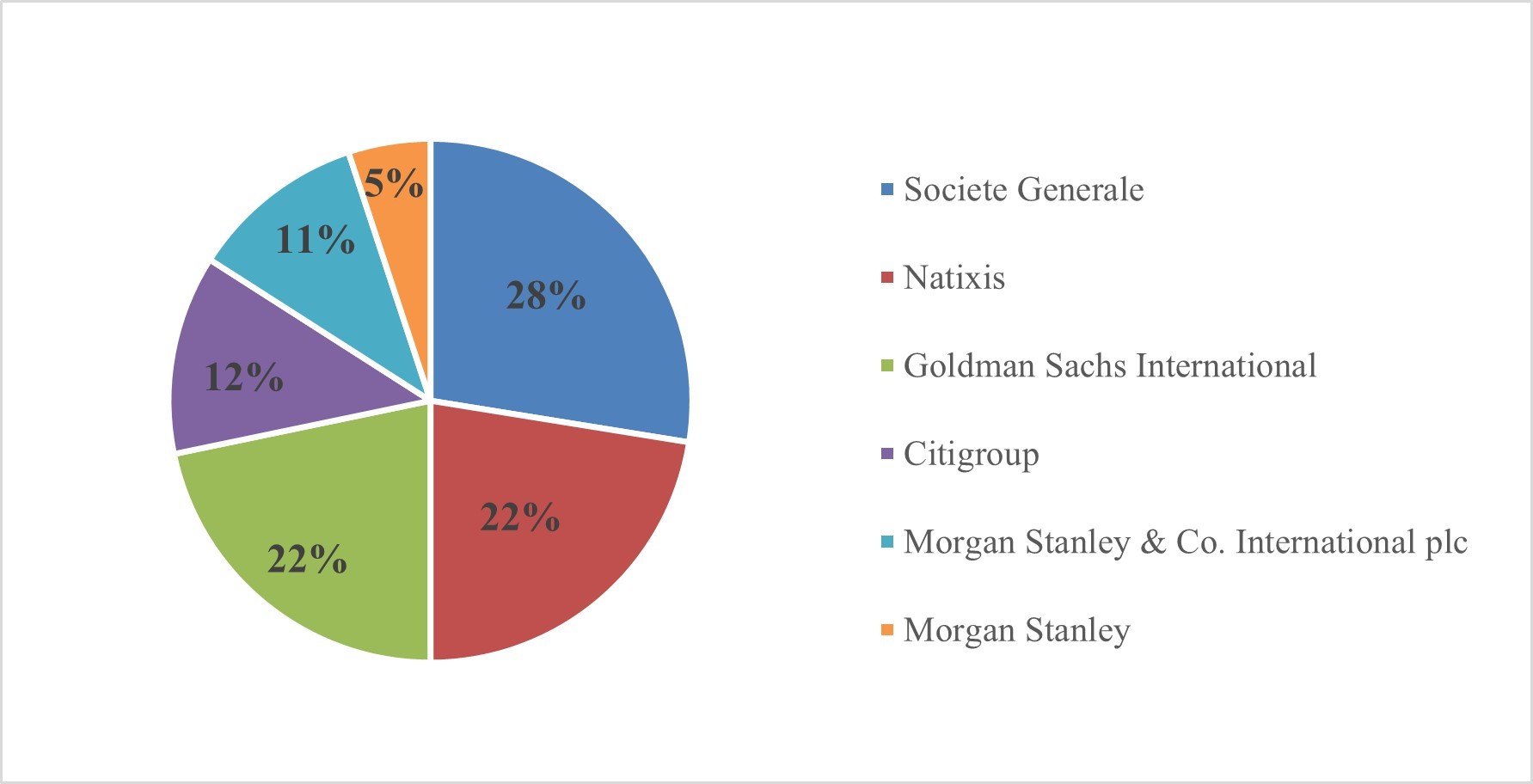

A total of 6 counterparty banks have been behind the 10:10 Plans, with the most common being Société Générale, accounting for 38 Options with the majority of these further diversifying the counterparty risk across four alternative major financial institutions.

10:10 Counterparty Breakdown by Products Issued

The counterparty bank for the December 2021 10:10 Plan is Citigroup Global Markets Ltd.

Another relatively new differential amongst the 10:10 Plans is the index deployed as the underlying. Whilst every issue of the 10:10 have been indirectly linked to the performance of the UK stock market, all but three of the first 111 Options were linked to the performance of the FTSE 100 Index. The three, which were issued in April 2016, were linked to the FTSE 100 Index and Euro Stoxx 50 Index. The most recent 27 Options issued derive their performance from the FTSE Custom 100 Synthetic 3.5% Fixed Dividend (CSDI) Index. Following the pandemic, the cause for, and rationale behind the change in underlying is explained here.

Of the 138 options released into the retail space, 41 (including the three dual index plans) have matured so far, producing capital gains for investors. To allow comparison, we have included the maturity performance of all FTSE 100 linked capital-at-risk autocall products in the sector since the first 10:10 maturity in October 2018.

|

|

10:10 Maturities |

All FTSE Linked Capital-at-Risk Autocall Maturities |

|

Number of maturity products |

41 |

339 |

|

Number returning a positive outcome |

41 |

339 |

|

Number returning capital only |

0 |

0 |

|

Number returning a loss |

0 |

0 |

|

Average total gain (%) |

26.54 |

17.23 |

|

Average term (years) |

2.9 |

2.33 |

|

Average annualised return (%) |

8.53 |

7.37 |

|

Average annualised return upper quartile (%) |

11.19 |

9.68 |

|

Average annualised return lower quartile (%) |

6.47 |

5.62 |

The 10:10 maturities have achieved an annualised return of 8.53% across an average term of almost three years, outperforming the sector average annualised return by 1.16%.These amply inflation busting figures are certainly nothing to be scoffed at, not least because the FTSE 100 hasn’t enjoyed similar performance.

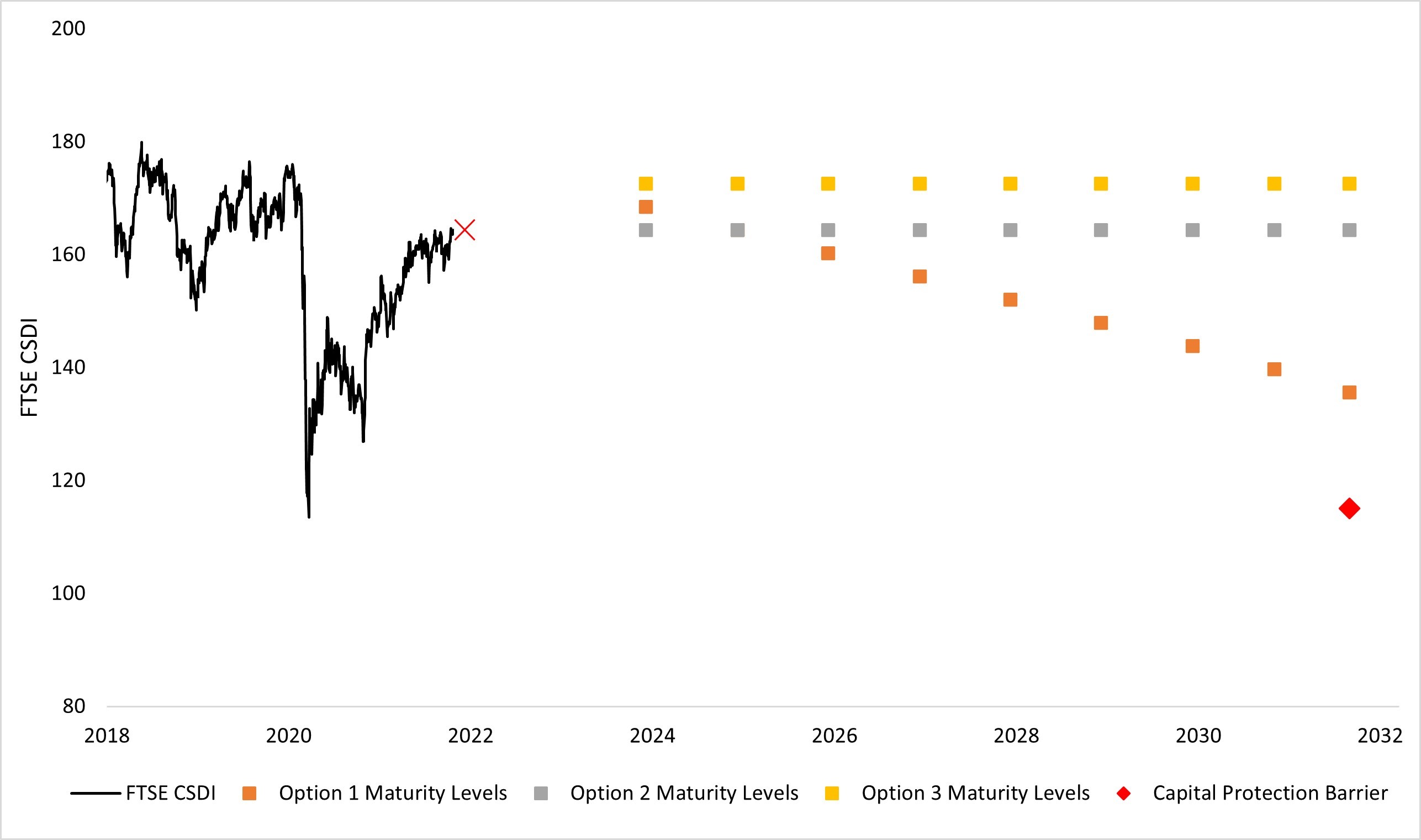

94 options remain in force, with three further options set to strike on 17th December 2021 – a step down, an at-the-money and a hurdle option – each linked to the performance of the FTSE CSDI. None of the plans in issue will mature with a loss unless they fail to mature early and the FTSE 100 closes below 5,331 (or FTSE CDSI below 115) at the end of their ten-year terms, or the counterparty defaults.

FTSE CSDI data sourced from Mariana

Full details on the latest 10:10 Plan, including Lowes Financial Management’s Summary Papers, can be found here.

Product data throughout sourced from StructuredProductReview.com.

Structured investments put capital at risk.

Past performance (actual or simulated) is not a guide to future performance.

Disclosure of interests: Lowes has provided input into the concept, development, promotion and distribution of the 10:10. Lowes has a commercial interest in these investments as a result of its involvement. Where Lowes is involved in advice on these investments to retail clients, it will not receive benefit of any fees for its involvement, other than those fees payable by the client to Lowes.

Also in this section

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶