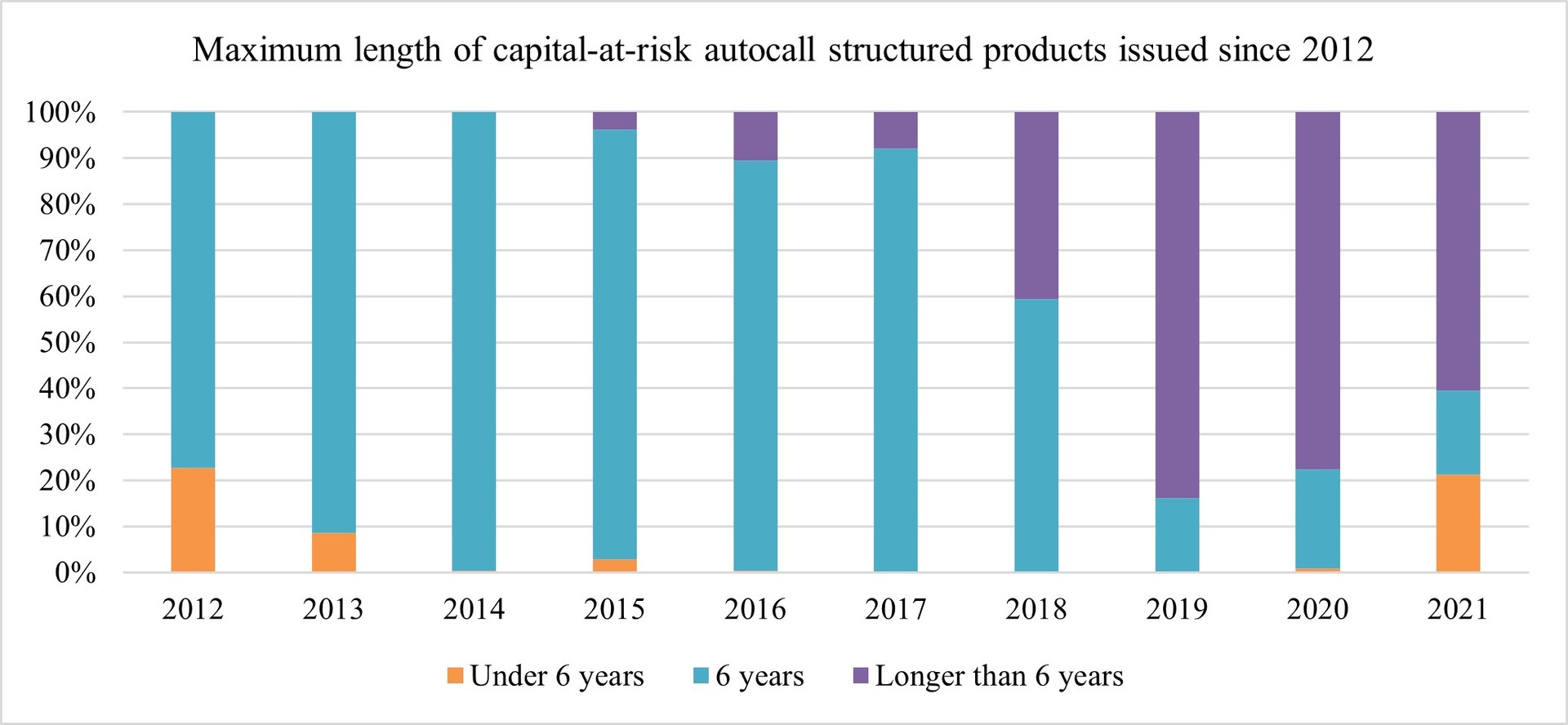

Over the previous decade Lowes Financial Management have been consistent in our advocacy of an extended maximum investment term for new issue autocall structured products. In our Retail Structured Product Review of the Sector 2010 – 2019 we outlined several crucial developments enjoyed by the sector, including the extended maximum investment term of capital-at-risk autocalls[1]. By way of illustration, between 2010 and 2015 no capital-at-risk autocalls released into the sector had a maximum duration of over six years, whereas by 2019 84% of all new issues had a maximum duration of more than 6 years.

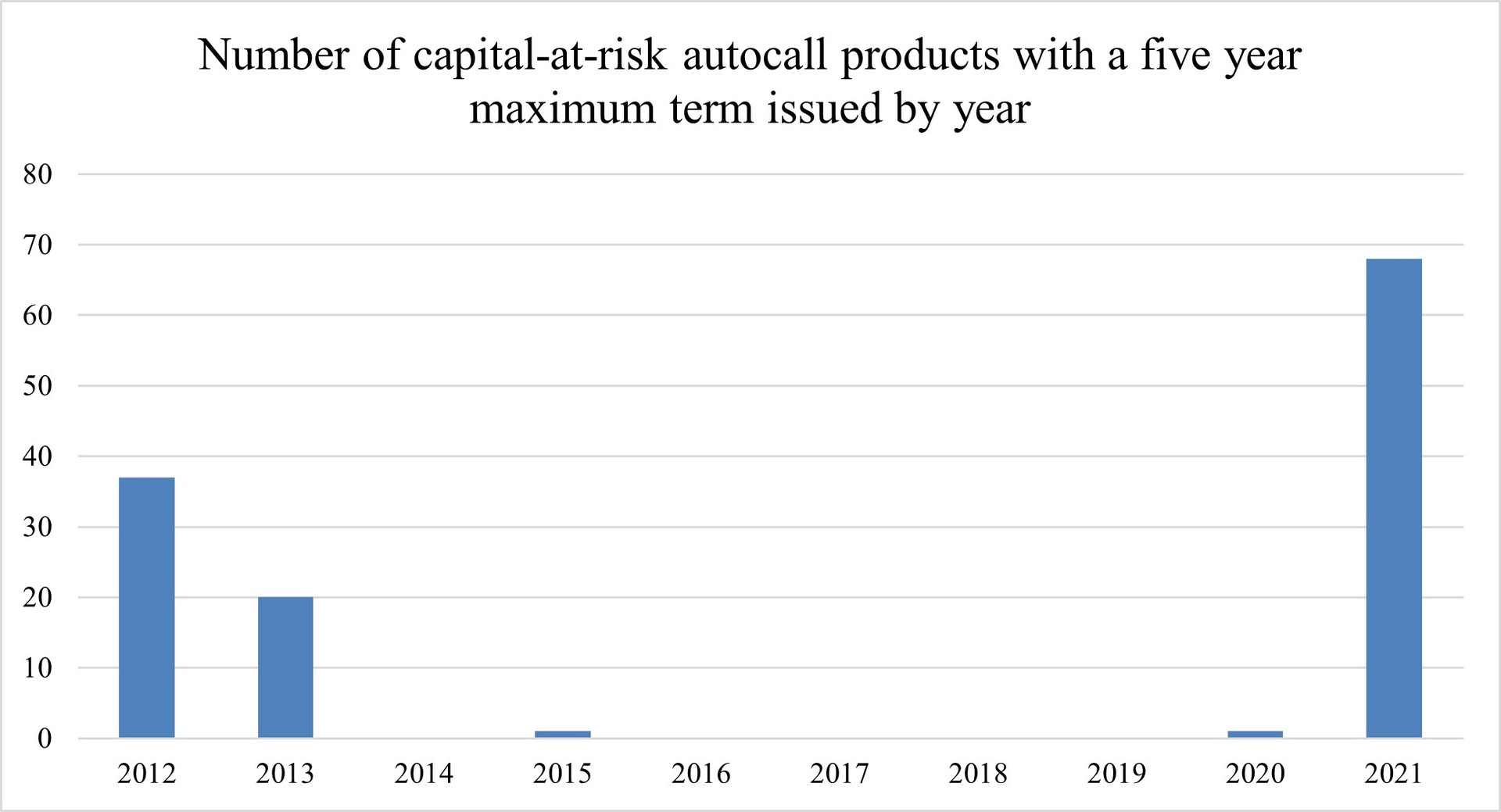

However, over the last year there has been a significant re-emergence of autocall products being released into the UK retail space with reduced maximum investment terms of not just 6 years, but 5 years.

Whilst we can only speculate as to the causation of this trend, we can observe correlation, and it appears as though issuing banks are increasingly erring on the side of caution when hedging their long-term risk following the market correction of 2020. The first 5-year maximum term capital-at-risk autocall issued since 2015 was in late 2020, and since then a further 68 autocalls with a maximum term of 5 years have been issued.

In our view, this recent trend is potentially problematic for the sector because the move to a longer maximum duration autocall contract repositioned the investors’ exposure to market risk in the event of a market downturn in the early years, perhaps as a result of another black swan event. The extended maximum term allows a longer period for the underlying to recover under adverse market conditions and the impact of snowball coupons meaning that the gain achievable will increase year on year.

Of course, conversely, a shorter investment term allows less time for a market recovery with fewer maturity observations and a restricted scope for the accumulation for snowball coupons. Regardless of the ultimate outcome, the peace of mind of having, say, eight years for a dramatic downturn to recover, versus just three could prove very comforting.

In summary, it is fundamentally our view that common sense should prevail here; the longer a plan has to run, the greater the chance of positive maturity through recovery in the event of a market crash, whilst benefiting from snowballing coupons. Those who invested prior to the market crash in 2020 would have far more reassurance from their fixed term investment with ten years to run, than those with just five.

Whilst ultimately, we hope that no situation arises whereby short term autocalls are caught by adverse conditions to loss-making effect, we will continue to advocate the obvious benefit in the extended maximum term.

Past performance is not a guide to the future.

Structured products place capital at risk.

[1] Retail Structured Product Review of the Sector 2010 – 2019

Also in this section

- Q1 2024 issuance

- Q1 2024 maturity results

- Structured Products – AAAAAGH!

- Hop in CIBC

- Re-enter Santander

- How to build a financial fortune - revisited

- Issuance in 2023

- Where's the risk?

- Questionable offerings

- Challenging the case against structured products - 'Loss of dividends'

- Navigating the investment landscape

- Challenging the case against structured products - Counterparty risk

- 6-year autocalls approaching final destination

- 1,750 FTSE capital at risk autocall maturities

- The leopard that changed her spots

- Q3 2023

- Challenging the case against structured products - Keydata

- Dilemmas for UK IFA's and the unique role of Structured Products

- 'High charges'

- Precipice bonds

- Intro

- FTSE 100 Contingent Income

- Indexing the indices

- Something different

- Investing through volatility

- 100 10:10s

- The best or worst?

- The 10%/25% 'Rule' that never was

- Structured products and the yield curve

- Fixed income: Capital at risk?

- Prospects for UK inflation - and fun with A.I!

- The Barrier Debate

- More Deposits for now

- Last of the Americans

- What if?

- Time heals all wounds, we hope...

- How to diversify portfolios using structured products?

- The Proof Is In The Pudding...

- Debunking Structured Misconceptions

- 1,500 FTSE Capital-at-Risk Autocall Maturities

- Q3 2022 Maturity Results

- What do we prefer?

- Deposits vs Capital ‘Protected’

- There’s time yet…

- Where did you invest your clients?

- A Six-Month Reflection

- Return of the Rev Con

- Happy 2nd Birthday FTSE CSDI

- Q2 2022 Maturity Results

- The best and worst yet still the best

- Critique my Suitability - Mariana 10:10 Plan June 2022 (Option 2)

- 10/10 for 55 10:10’s

- Q1 2022 Maturity Results

- 'How to build a financial fortune': a follow up

- Critique my Suitability - Mariana 10:10 Plan April 2022 (Option 2)

- 2021 Capital-at-Risk Autocall Maturity Review

- An unwelcome return...

- CSDI's First Birthday

- Bon Anniversaire

- Introducing the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index

- Q3 2021 Maturity Results

- Critique my Suitability - Mariana 10:10 Plan October 2021 (Option 2)

- Blurring the lines...

- Beware of false knowledge; it is more dangerous than ignorance

- Good news, bad news...

- Certainty is Certainly a Benefit

- Critique my Suitability - Mariana 10:10 Plan September 2021 (Option 2)

- A Twenty-Year Progression

- Q2 2021 Maturity Results

- Nine 8:8s Post Positive Returns in Falling Markets

- Critique my Suitability

- Q1 2021 Maturity Results

- Morgan Stanley’s Marvelous Maturity Medley

Current Products

We review the UK's retail structured investment sector, providing pertinent support for Professional Advisers and relevant research tools.

View all ⟶